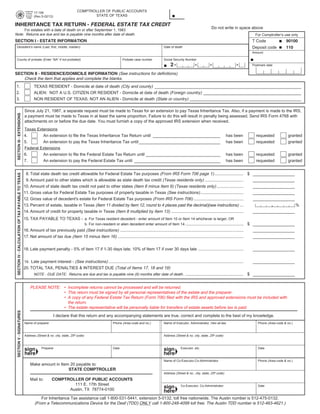

Texas Inheritance Tax Forms-17-106 Return -- Federal Estate Tax Credit (For date of death on or after 9.1.83)

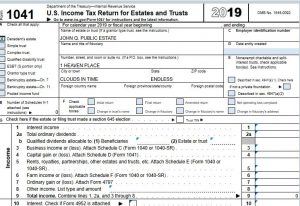

Philadelphia Estate Planning, Tax, Probate Attorney Law Practice Limited to: Business, Corporation Law Tax, Probate, Estate Administration, Wills, Trusts - Estate and Trust Tax Return Preparation

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at12.23.24PM-c985dd13718d43b09af3cb3194534e41.png)

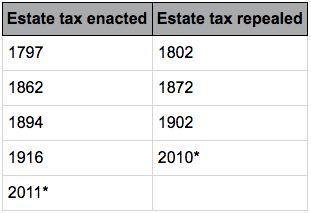

:max_bytes(150000):strip_icc()/estate-tax-exemption-2021-definition-5114715-final-b76b790839b8411db1f967c82ef4b281.png)

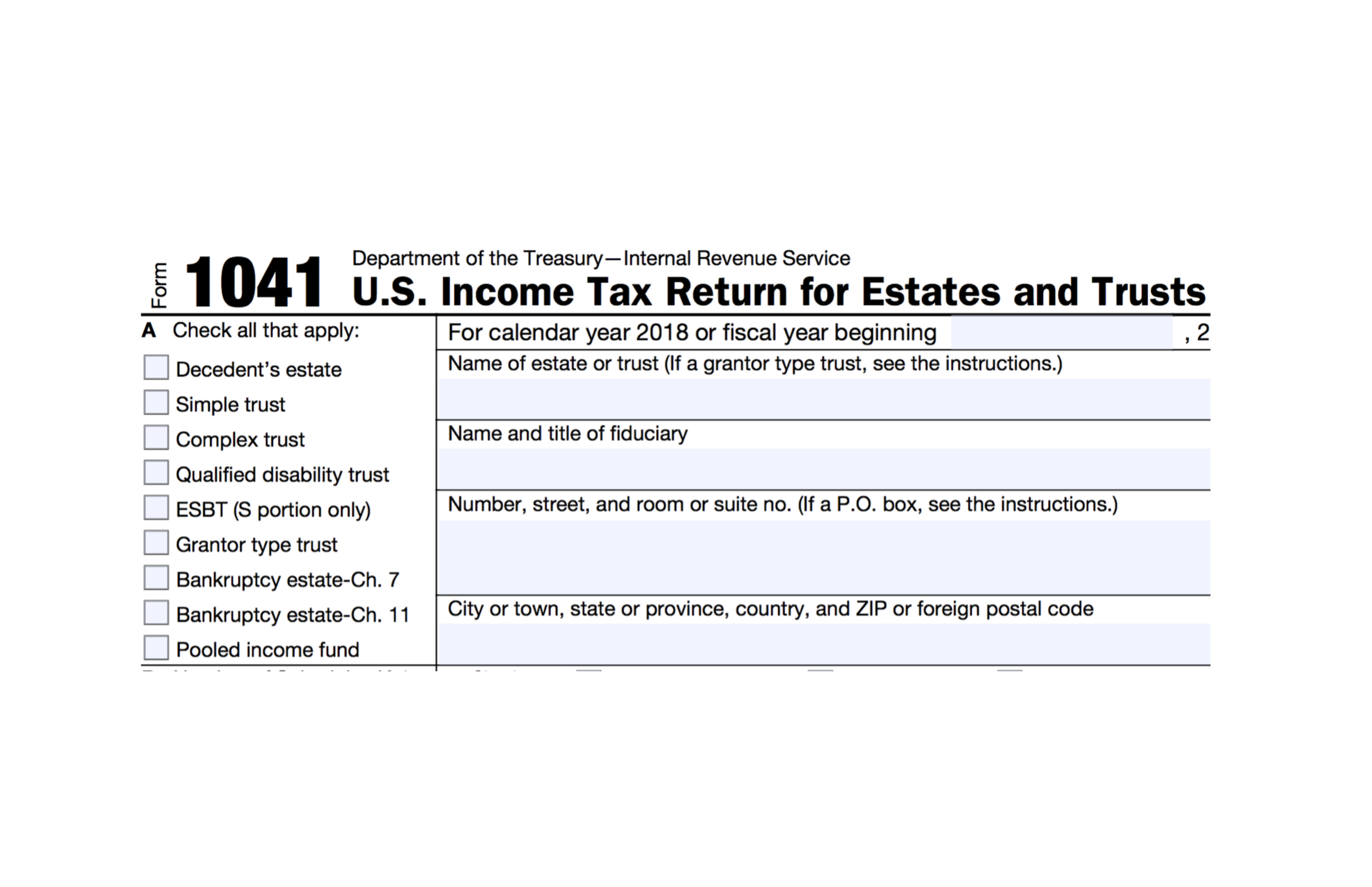

:max_bytes(150000):strip_icc()/2022Form1041-42ed301e7b3f4e1397e75fc675aea68f.jpg)